An experienced online casino operator wanted to raise capital to build one of the first metaverse casinos. The plan: use NFT collections as the primary fundraising vehicle.

The bar was high:

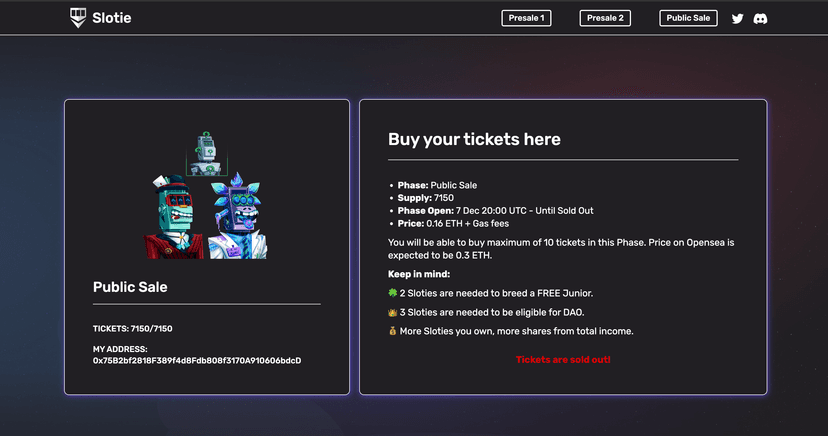

- Raise 7+ figures in a single day without contract failures or exploits.

- Handle thousands of concurrent mints without gas wars, failed transactions, or over‑minting.

- Enforce complex sale logic: presales, public sales, per‑wallet limits, whale tiers, giveaways, and strict supply caps.

- Protect buyers and the team from security issues around whitelist manipulation, double claiming, and massive ETH balances sitting in contracts.

- Do it again for a follow‑up collection, with better gas efficiency, more flexibility, and clean integration into a broader “Slotie ecosystem” (staking, breeding, payouts, metaverse integrations).

They needed not just a mint contract, but a full, battle‑tested sale system that could safely move millions in minutes.